How to screen stocks

In this article, we'll explain how you can use one of the most powerful features of Streamlined Finance: the Screener component.

Unlike screeners in many platforms, in Streamlined it's fully customizable. You can compose your datasets, but also customize your columns.

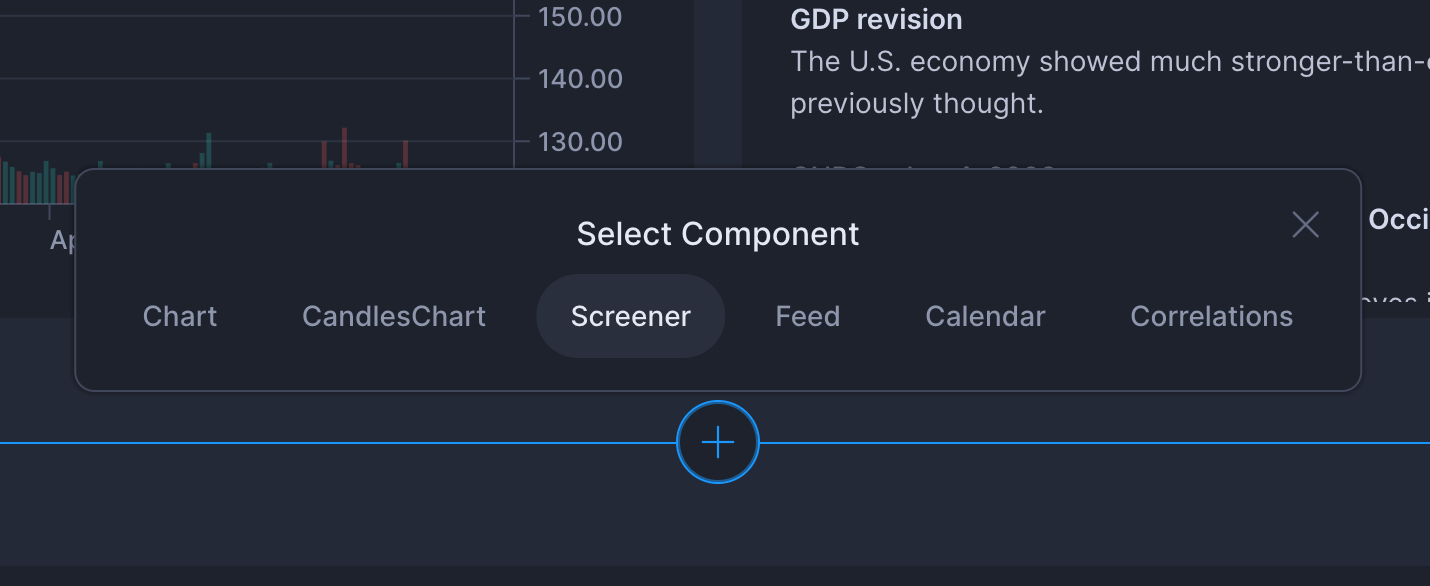

Below your existing components, you can add your Screener component. After you've selected the Screener component, you will be prompted to select datasets.

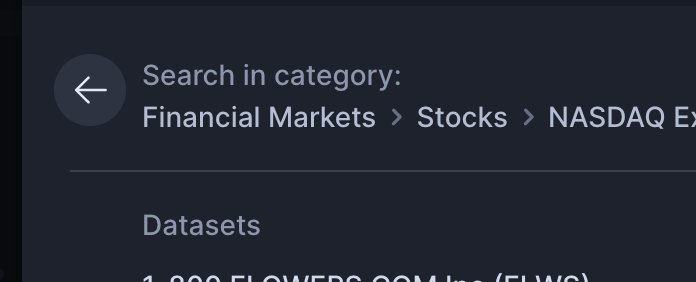

Selecting Datasets

To select datasets, you can search in the top search bar or explore by clicking through the categories.

How many datasets can I add?

If you are using the free plan, then you are limited to 5 datasets per Screener component, whereas the Premium plan allows you to have an unlimited amount of datasets, so you can really go wild.

- Free Plan: 5 datasets per Screener

- Premium Plan: Unlimited datasets per Screener

Customizing Columns

Apart from choosing your datasets, Streamlined also allows you to customize your columns for your screener. This makes it really powerful as you can not only see price changes, but also fundamentals and technicals.

For price changes you can choose:

- 1D %: 1 Day Change Percentage

- 1W %: 1 Week Change Percentage

- 1M %: 1 Month Change Percentage

- 3M %: 3 Months Change Percentage

- 6M %: 6 Months Change Percentage

- 1Y %: 1 Year Change Percentage

- YTD %: Year to Date Change Percentage (or Current/This Year Change %)

- MTD %: Month to Date Change Percentage (or Current/This Month Change %)

For fundamentals you can choose:

- Beta (a measure of an investment's historical volatility compared to the S&P 500)

- P/E Ratio (Price to Earnings Ratio)

- PEG Ratio (Price to Earnings to Growth Ratio)

- Profit Margin

- Operating Margin TTM

- Market Capitalization

- Earnings Per Share

- Revenue Per Share TTM

- Earnings Growth YoY%

- Revenue Growth YoY%

For technicals you can choose:

- Moving Average

- Relative Strength Index

- Average True Range

- Stochastic

Columns: Technical Indicators

Technical Indicators are not only useful in Charts, but also provide valuable insights in Screeners as you can quickly spot opportunities in a single glance.

The ATR indicator

ATR stands for Average True Range and is used to see the volatility of a stock. This number shows the average price range for the selected period (21 days in the screenshot above).

Additionally, we show this in percentage (ATRP) to quickly compare the volatility between stocks. In the above example, we can clearly see that the 2nd stock has changed the most in the last 21 days as it's percentage (4.3%) is the highest percentage of the 4.

The MA Indicator

The moving average indicator can be used to quickly spot which stocks are in an uptrend or downtrend.

A green up-arrow, means that the stock is trading above the moving average (21 day moving average in the screenshot).

A red down-arrow, means that the stock is trading below the moving average.

The RSI Indicator

The Relative Strength Indicator is one the most utilized indicators on charts, but can be great for screeners as well. It allows you quickly see when stocks are overbought and oversold. To make it even easier, we have color coded it for you.

Overbought

- Above 70, it's green

- Above 80, it's stronger green with a green background

- Above 90, it's dark green with a green background

Oversold

- Below 30, it's red

- Below 20, it's red with a red background

- Below 10, it's dark red with a red background

The Stochastic Indicator

The stochastic indicator is a powerful short-term momentum indicator that exacerbates price movements, which makes it specifically useful for entry's and exits of positions.

As this is a relatively unknown indicator, we have simplified the options into 3 inputs:

- 4 3 3 - Very short term

- 8 3 3 - Medium short term

- 12 3 3 - Long short term

To illustrate an example of how this could be used, imagine that we've identified that a stock is in a uptrend and we're planning to buy the dip. A great entry, would then be when the stochastic is at a low number (< 30 indicates oversold, similar to the RSI), color coded red, and wait for the arrow to be green, which indicates that the price has started to move upwards.

Is the Price Real-time?

Depending on the financial instrument, the last price is updated at a different rate.

On the right of the name, there is a small colored circle indicating when last price was last updated.

- Green - Realtime

- Yellow - Delayed data (15/20min)

- Orange - End of day data